All that seems to matter to the stock market these days is what's happening with the U.S. Treasury's debt ceiling. Will it be raised? Will America default on its debt? Can President Barack Obama and the Republicans actually come to an agreement?

So far, despite all the political posturing, a short-term solution still seems to be in the cards. Failure to act simply isn't an option. Obama knows that. The Republicans know that. The corporate lobbyists have done their job. And Wall Street has already sounded the alarm, with credit analysts at Moody's and Standard & Poor's casting doubt on the nation's creditworthiness.

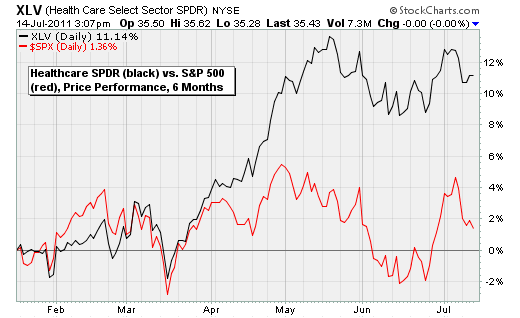

For all the talk of spending cuts, tax hikes and short-term solutions versus big fixes, there is one fundamental truth that isn't getting a lot of play: Runaway health care costs are bankrupting the country. And while that's been great news for investors in the health care sector in recent months, with the Health Care SPDR (XLV) outperforming the broad market by more than 11% since February, it jeopardizes the debt ceiling debate, the fate of the economy and the very future of the country.

Any real, lasting solution, which is what Obama wants, needs to tackle this problem, come hell, high water or "death panels." Why?

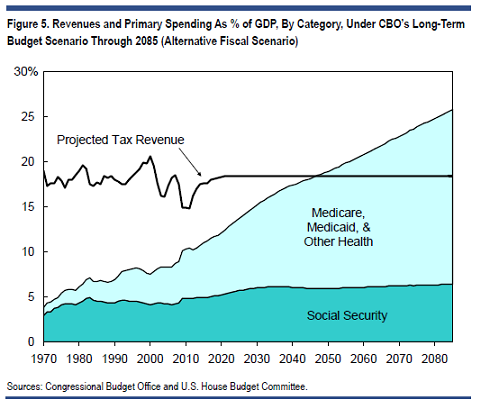

First some quick background. As I discussed in a column about the budget deficit a few months ago, ("Pulling the plug on the economy?"), much of the current deficit is being caused by the lousy economy and should improve as growth re-accelerates as I expect. Tax revenues will improve as people get back to work and make more money. And expenditures should fall as spending on things like unemployment benefits, food stamps and other assistance programs drops.

The really irritating thing is that all of this spending isn't getting us very much, according to Wieting's research: America spends nearly $8,000 per person on health care, versus $2,878 in Japan, but life expectancy here is just 78 years, versus 83 in Japan. Other measures of care quality, such as infant mortality, tell the same story.

If Obama and the Republicans are going to really put this country back on the path of fiscal sustainability, they must address this problem. Otherwise, even if the debt ceiling is raised and the Treasury avoids defaulting on its debt this summer, the problem won't go away. It will only get worse. And one day, we may have no choice but to renege on our promises to our creditors to pay for the promises we've made to seniors and the less fortunate.

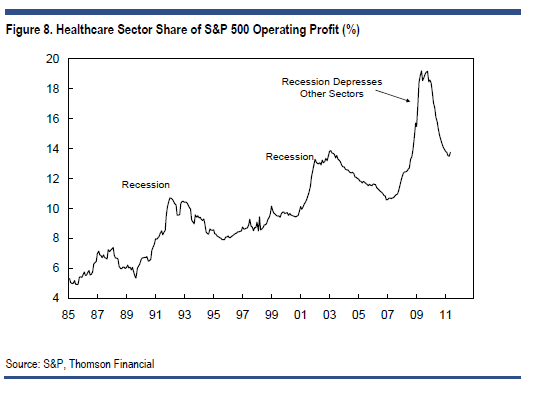

For investors, it's been a great ride. Health care's share of profits has been rising for decades, enjoying big spikes during recessions but continuing a steady upward path. That's what makes the sector so attractive during times of market turmoil like now. But it's also the cause of that turmoil right now.

Citigroup equity strategist Tobias Levkovich recommends avoiding health care stocks for now. Not only should the group underperform as the economy revs up again, but it will likely come under fire as politicians on both sides of the aisle look for long-term solutions to the fiscal nightmare we're in. There are no other options.

source

No comments:

Post a Comment